Imagine that you’ve found your dream car, negotiated the perfect price, and you’re ready to seal the deal. But then comes the moment of truth – how are you going to pay that hefty down payment? The burning question: do car dealers take credit cards for down payment transactions? Well, buckle up because the answer isn’t as straightforward as you might think!

The short answer is: Yes, most car dealers do take credit cards for down payment purposes, but with significant limitations and potential fees. Understanding whether car dealers take credit cards for down payment situations is crucial for your car-buying strategy. You might even be able to use a card to buy a vehicle. However, it’s more likely that the dealership will take a credit card for a down payment rather than the full purchase price.

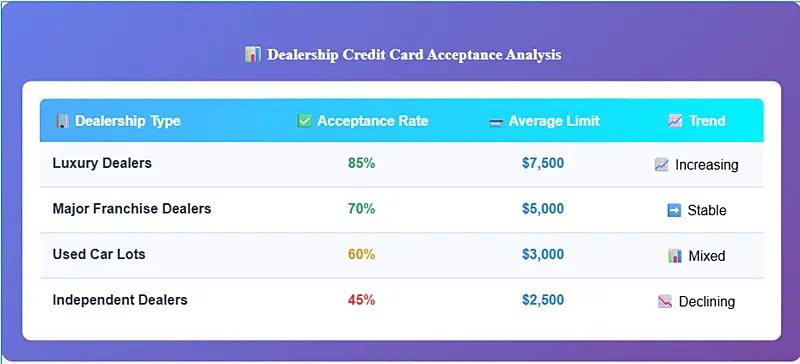

Credit Card Acceptance Rates by Dealership Type

But wait – before you get too excited about earning those sweet credit card rewards on your car purchase, there are some crucial details that could make or break your financial strategy. The question “do car dealers take credit cards for down payment” has multiple layers worth exploring. Let’s dive deep into the world of automotive financing and credit card transactions.

Table of Contents

Check out our automotive calculators!

The Reality Check: Not All Dealers Play the Same Game

Here’s where things get interesting (and potentially frustrating). When asking do car dealers take credit cards for down payment, the reality is that not all dealerships give the same answer. Some might have a cap on how much you can charge, while others won’t accept credit cards at all. This inconsistency means you could walk into one showroom ready to swipe—and walk out scrambling to find your checkbook.

So why do policies vary so much? One word: fees. Every time a customer pays with a credit card, the dealership gets hit with processing fees that typically range from 2% to 3%, sometimes even higher. On a $5,000 down payment, that’s $100–$150 straight out of the dealer’s profit.

Because the automotive industry runs on razor-thin margins, these fees add up fast. Some dealers choose to absorb them as a gesture of good service. Others pass the fees along—or simply say no to credit card payments. That’s why it’s essential to call ahead and confirm: do car dealers take credit cards for down payment at the specific location you’re visiting?

The 5 Shocking Facts About Using Credit Cards for Car Down Payments

1. Most Dealers Cap Credit Card Payments at $3,000–$5,000

This might be the biggest surprise for first-time car buyers. Even if a dealership accepts credit cards, they typically impose strict limits. Most dealerships limit the amount you can charge on a credit card to between $3,000 and $5,000.

So if you’re planning to put down $10,000 on that luxury SUV using your credit card, you might need to adjust your strategy. Before assuming the answer to do car dealers take credit cards for down payment includes any amount you want, understand these limits exist because:

- Higher transaction amounts mean higher processing fees

- Credit card disputes can be costly and time-consuming

- Cash flow management becomes more complex with large credit transactions

2. You Might Get Hit with Processing Fees

Here’s where that “free” credit card swipe becomes expensive. When asking do car dealers take credit cards for down payment, you’ll find that even if they say yes, many dealerships pass along the transaction fee—often 3% or more.

Think about it: if you’re putting down $5,000 and the dealer charges you a 3% fee, that’s $150 out of pocket just to use your credit card. That added cost can wipe out any rewards or cashback you were hoping to earn.

So even if the answer to do car dealers take credit cards for down payment is technically yes, the real question is—should you?

Processing Fees Comparison Chart

💰 Payment Method Cost Analysis

| 💳 Payment Method | 💸 Processing Fee | 🏪 Dealer Preference | ⚠️ Customer Risk |

|---|---|---|---|

| Credit Card | 2.5-3.5% | ❌ Low | ⚠️ Medium |

| Debit Card | 1.0-2.0% | 🟡 Medium | ✅ Low |

| Bank Transfer | $10-25 flat | ✅ High | ✅ Low |

| Cashier’s Check | $0 | 🌟 Very High | ✅ Low |

| Personal Check | $0 | 🟡 Medium | ⚠️ Medium |

| Cash | $0 | ✅ High | 🚨 High Security Risk |

3. Your Credit Utilization Could Tank Your Credit Score

This is the hidden danger many car buyers overlook. If you max out your credit card for a down payment, your credit utilization ratio skyrockets. Since utilization makes up about 30% of your credit score, financial experts recommend keeping it below 30%—ideally under 10%.

Let’s say you have a credit card with a $10,000 limit and charge a $5,000 down payment. Suddenly, you’re at 50% utilization on that card, which could cause your credit score to drop right when you need it most for auto loan approval. So before acting on the question do car dealers take credit cards for down payment, make sure you understand how that swipe could affect your overall credit health.

Credit Utilization Impact on Credit Score

📊 Credit Score Impact Guide

| 📈 Utilization Rate | 🎯 Credit Score Impact | 💡 Recommended Action |

|---|---|---|

| 0-10% | ✅ Positive/Neutral | 🎉 Maintain |

| 11-30% | ⚠️ Slight Negative | 📉 Pay down when possible |

| 31-50% | 🟠 Moderate Negative | 🚨 Pay down immediately |

| 51-70% | 🔴 Significant Negative | ⚡ Urgent attention needed |

| 71-90% | 🚨 Severe Negative | 🆘 Crisis management |

| 91-100% | 💥 Extremely Negative | 🚑 Emergency action required |

4. The Timing Could Affect Your Loan Approval

Here’s something that could really throw a wrench in your car-buying plans: the timing of your credit card payment versus your loan application. If you swipe your card for the down payment and immediately apply for financing, that new balance might show up on your credit report and hurt your debt-to-income ratio.

Lenders look at your entire financial picture, and a suddenly maxed-out card could raise concerns about your ability to manage new debt. Before asking do car dealers take credit cards for down payment, consider how it might impact your credit profile and loan terms.

5. Cash Advances Are Almost Never Worth It

Some desperate buyers think they can outsmart dealer policies by taking a cash advance from their credit card. Don’t do it. Even if the answer to do car dealers take credit cards for down payment is no at your dealership, there are safer alternatives. Cash advances usually come with:

- Higher interest rates (often 25–30% APR)

- Immediate interest charges (no grace period)

- Additional fees (typically 3–5%)

- Lower available limits

It’s a financial trap you should avoid.

Understanding Dealer Payment Policies: The Inside Scoop

So why do dealerships have such varying policies when it comes to credit card payments? The answer to “do car dealers take credit cards for down payment” depends on multiple behind-the-scenes factors within the automotive retail industry.

Transaction Fees Are Eating Profits

Some dealers have strict policies against it due to processing fees, which can be as high as 3%. For a dealership making just a few thousand dollars in profit on a vehicle, losing $150–$300 to fees on a down payment significantly cuts into margins.

Chargeback Concerns

Credit card payments can be disputed long after the sale, leading to chargebacks that not only reverse the payment but also cost the dealer additional fees. Cash and certified checks don’t carry that risk.

Cash Flow Management

Credit card payments usually take 1–3 business days to settle, which can disrupt a dealer’s cash flow and delay internal processes. So next time you wonder, do car dealers take credit cards for down payment, remember—it’s not just about convenience; it’s about how the dealership operates financially.

Smart Strategies: How to Use Credit Cards Wisely for Car Purchases

Strategy 1: The Rewards Optimization Play

If you’ve confirmed the answer to do car dealers take credit cards for down payment is yes at your chosen dealership, make sure you’re maximizing the benefits. Consider using a card that offers:

- High cash back rates on large purchases

- Sign-up bonuses that you can hit with the down payment

- Extended warranty protection for your vehicle

- Purchase protection insurance

Strategy 2: The Multiple Card Approach

Since most dealers cap individual credit card transactions, you could potentially use multiple cards to spread out a larger down payment. Before pursuing this, always verify: do car dealers take credit cards for down payment using more than one card? This strategy:

- Keeps utilization lower on each individual card

- Allows you to hit sign-up bonuses on multiple cards

- Spreads the risk across different accounts

Important note: Make sure the dealership allows multiple credit card transactions before attempting this strategy.

Strategy 3: The Timing Game

Once you’ve established that do car dealers take credit cards for down payment at your dealership, timing becomes crucial:

- Apply for your auto loan first, before charging the down payment

- Make the credit card payment as close to closing as possible

- Pay down the credit card balance quickly to minimize interest charges

Alternative Down Payment Methods: When Credit Cards Don’t Work

If the answer to do car dealers take credit cards for down payment is no, there are still viable alternatives:

Bank Transfers and Wire Transfers

Many dealers prefer electronic bank transfers for larger down payments. Benefits include:

- Lower fees for the dealer

- Faster settlement than credit cards

- No risk of chargebacks

- Higher transaction limits

Certified Checks and Cashier’s Checks

The traditional favorite of car dealers everywhere. These payment methods offer:

- Guaranteed funds

- No processing fees

- Immediate availability

- No dispute risk

Personal Checks (With Caution)

Some dealers will accept personal checks, but they typically:

- Hold the vehicle until the check clears

- Require verification of funds

- May charge hold fees

- Prefer dealing with established customers

The Credit Score Impact: What You Need to Know

Using a credit card for a car down payment can affect your credit score in several ways. So before asking do car dealers take credit cards for down payment, consider both the benefits and the risks.

Positive Impacts:

- Shows active use of credit accounts

- Can improve payment history if paid on time

- May help with credit mix if it’s your only revolving account

Negative Impacts:

- Increases credit utilization ratio

- Could trigger overlimit fees if you exceed your limit

- May signal financial stress to future lenders

The key is managing your credit responsibly throughout the car-buying process.

Dealer-Specific Policies: What to Expect

Even if the general answer to do car dealers take credit cards for down payment is yes, dealer policies vary widely:

Luxury Dealerships

High-end dealerships often have more flexible credit card policies because:

- Their customers expect premium service

- Higher profit margins can absorb processing fees

- They deal with larger transactions regularly

Used Car Lots

Smaller used car dealers might:

- Have stricter credit card limits

- Prefer cash transactions

- Pass processing fees directly to customers

Major Franchise Dealers

Large franchise dealerships typically:

- Have standardized payment policies

- Accept credit cards with set limits

- Offer multiple payment options

Common Myths Debunked

Myth 1: “All Dealers Must Accept Credit Cards”

Reality: There’s no legal requirement—dealers can choose whether or not to accept cards. Always confirm directly: do car dealers take credit cards for down payment at the dealership you’re working with?

Myth 2: “Credit Card Rewards Always Make It Worth It”

Reality: High processing fees and potential interest charges often outweigh any rewards.

Myth 3: “Using a Credit Card Protects Me Better Than Cash”

Reality: While credit cards offer dispute protection, automotive purchases also have protections like lemon laws and warranties.

Myth 4: “I Can Always Do a Cash Advance if They Don’t Take Cards”

Reality: Cash advances come with steep fees and high interest—bad idea for car buying.

Myth 5: “The Processing Fee Is Tax Deductible”

Reality: For personal vehicle purchases, that fee isn’t deductible.

Regional Differences in Credit Card Acceptance

Some regions are generally more accepting of credit card payments, especially in tech-heavy areas where customers expect digital options. On the East Coast, a more traditional approach prevails, with many dealers preferring checks or bank transfers. In the Southeast, policies vary depending on dealership size and type. The Midwest tends to be conservative, with lower caps on card payments. Always check with your local dealership to confirm: do car dealers take credit cards for down payment in your area?

FAQ: Do Car Dealers Take Credit Cards For Down Payment

Q: Can I use multiple credit cards for a single down payment?

A: Some dealers allow this, but you’ll need to ask specifically about their policy on whether do car dealers take credit cards for down payment using multiple cards. Each transaction may be subject to individual limits and fees.

Q: Will using a credit card for my down payment affect my auto loan approval?

A: It could, especially if it significantly increases your credit utilization ratio or debt-to-income ratio.

Q: Are there any credit cards specifically designed for car purchases?

A: While there are auto-focused credit cards, they’re typically for maintenance and gas—not actual vehicle purchases.

Q: Can I dispute a car purchase made with a credit card?

A: Yes, but automotive purchases have specific protections, and disputing may be more complex than typical retail transactions.

Q: Should I use a business credit card for a personal vehicle purchase?

A: Generally no, unless the vehicle is strictly for business use. This could create tax and legal complications.

Q: What’s the average credit card limit dealers will accept?

A: Most cap credit card payments between $3,000 and $5,000, although policies vary. Always check if do car dealers take credit cards for down payment beyond these limits at your specific dealership.

Q: Can I negotiate the processing fee?

A: Sometimes—especially if you’re making a large purchase or have leverage in negotiations.

Q: Is it better to finance more and put less down to use my credit card?

A: Usually not. The higher interest on a bigger auto loan usually outweighs any rewards from your credit card.

My Final Thoughts: The Real-World Experience

I’ve been researching automotive financing for years, and I can tell you that the question “do car dealers take credit cards for down payment” is one of the most misunderstood aspects of car buying. Too many people walk onto dealer lots assuming they can just swipe their card for whatever amount they want, only to face disappointment and scrambling for alternative funding sources.

Here’s my honest take: Yes, car dealers do take credit cards for down payment in many cases, but it’s rarely the best financial decision. The combination of processing fees, credit utilization concerns, and dealer limitations usually makes other payment methods more attractive.

If you’re absolutely determined to use a credit card after confirming that do car dealers take credit cards for down payment is a yes at your chosen dealership, do your homework first. Call ahead to confirm the dealer’s policy, understand all fees involved, and have a backup payment method ready. Most importantly, make sure you can pay off that credit card balance quickly to avoid high interest charges that could cost you far more than any rewards you might earn.

The car-buying process is stressful enough without payment method surprises derailing your plans. Plan ahead, understand your options, and choose the payment method that makes the most financial sense for your situation – not just the most convenient one.

Need a mobile mechanic? Find one on the Mobile Mechanic Directory